2 Amal Airline (Amal) is the national airline of Jayland. It was originally owned by the government but was listed on the

local stock exchange when sold to private investors more than 20 years ago. The airline’s objective is to be the best

premium global airline.

Amal provides long- and short-haul services all over the world and is based at its hub at Jaycity airport. Amal has

been hit by a worldwide reduction in air travel due to poor economic conditions. The most recent financial results

show a loss and this has caused the board to reconsider its position and take action to address the changed

environment.

Amal has cut its dividend in order to conserve cash and it is trying to rebuild profitability by reducing costs by 14%.

The airline is capital intensive as it requires to maintain a large fleet of modern aircraft. The two major costs for the

airline are staff and fuel. In trying to renegotiate working conditions and pay, the management have angered the

unionised workforce. There has already been some strike action by the unions representing the aircraft crew and

ground staff and more is threatened. They are upset about changes to pension provisions which will require them to

make larger contributions and also, a reduction in the number of crew on each aircraft which they believe will require

them to work harder and so they want a compensating pay-rise.

Additionally, the board are pushing forward a large project to improve the design of the company website in order to

increase the number of passengers who check-in on-line and so would not require as much assistance at the airport.

The new design is also aiming to increase the number of passengers who book their tickets through the company’s

website rather than other resellers’ websites or at booking agents. The project is currently two months behind schedule

due to one of the main software suppliers becoming insolvent.

Finally, the board has been considering taking advantage of new technology in aircraft engines by making a large

investment ($450m) in new low-noise, fuel-efficient aircraft in an effort to reduce the environmental complaints

surrounding air travel and also cut costs.

Given all of the issues and projects affecting Amal, the CEO has tried to find a unifying view that will explain the

airline’s performance. She has heard that the performance prism may provide such a framework.

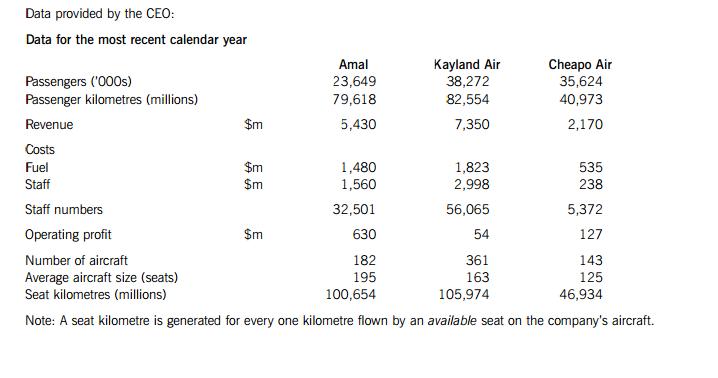

As further background, the CEO has supplied the data below on Amal and two of its main competitors. Kayland Air

is a government owned and run airline in the neighbouring country of Kayland. It has a similar mix of business to

Amal and targets a similar market. Cheapo Air is currently one of the most successful of the new privately-owned

airlines that have gained significant market share over the last 15 years by offering a cheap but basic short-haul

service to customers in and around Jayland. Cheapo Air subcontracts many of their activities in order to remain

flexible. The CEO wants you to calculate some suitable performance measures and explain the results.