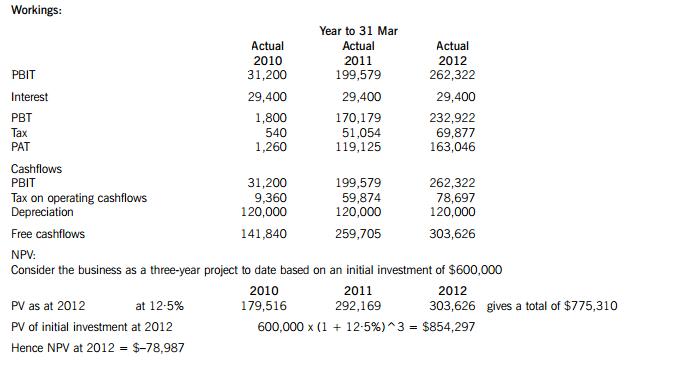

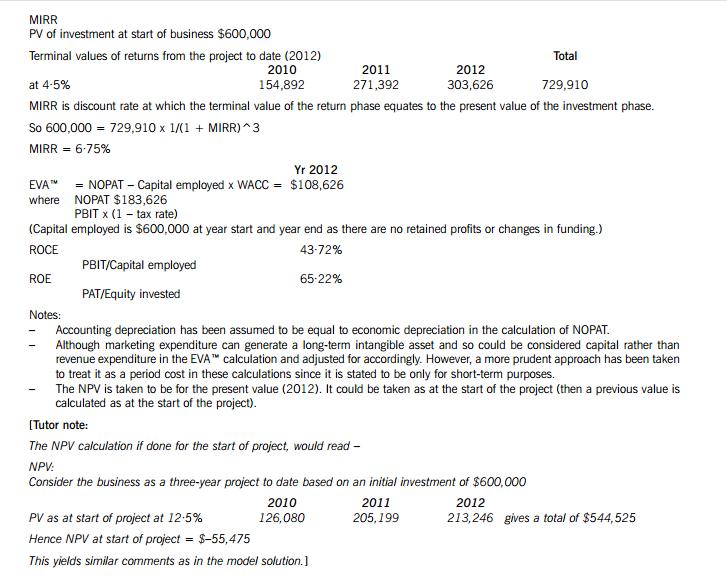

The business is currently performing well generating healthy after tax profit for the owners and a positive EVA™, which implies

the business is adding value for the shareholders.

The NPV and MIRR measures do not look healthy as normally a business would seek only investments that returned positive

NPV values or a MIRR above the cost of capital (12·5% for Metis). However, these are measures that take account of the

first three years trading and so include the understandably weak opening year’s performance when the business was building

up. They may provide a long-term view of historic performance but are less helpful in judging the current state of the business.

You may want to view the goal of reaching nil NPV as a long-term target for the business so at least meeting its cost of capital

(in fact it looks like the business will achieve this in the next year).

(iii) ‘What gets measured, gets done’

The idea behind the quote, ‘What gets measured, gets done’ is that the staff and management will only react to the

performance measures chosen by the owners. In other words, poor performance reporting can lead to inefficient

management. If an area is not measured then there is a danger that it is not efficiently managed and equally, if an area is

measured then there is the danger that it is over-managed. For example, the current report has annual revenue and the

previous two quarters’ revenues reported, therefore, it might promote the idea that quarterly growth is critical. However, it is

likely that the business is seasonal and so it would be more helpful to have a comparison of each quarter with the equivalent

quarter in the previous year. Otherwise, the owners may react to a fall in revenue shown when this is not controllable.

Further examples of the quote are given in the areas that the owners are complaining about in their meetings. Sheila has

complained that the staff are not smiling enough but there is no measure of customer satisfaction available in the current

report and so no way to quantify or substantiate this concern. This has resulted in Bert’s dismissive comment.

However, the control of electricity costs can be seen in the slowing growth of the utilities cost on the current report (the annual

increase has fallen from 3% to 0·5% pa in the last two years) and so the effectiveness of Sheila’s actions can be demonstrated

although the use of monetary totals and lack of these trend figures would mean that this is not immediately obvious. Bert’s

criticism of her work can at least be partially answered and so she can be encouraged to continue with these ideas.

Bert has complained that there is too much wastage of food and that he is devoting considerable staff time on instinct without

solid information. The problem is additionally complicated as it may be caused by purchasing lower cost but poor quality

produce or it could be caused by how the produce is handled and stored in the kitchen. The first cause is an issue for

procurement, which is not Bert’s area of responsibility, and so any actions of his are unlikely to address the problem. The

report needs to identify changes in gross margin which might indicate changes in procurement policy and it should also have

a measure of wastage such as the average actual cost of food per dish served compared to a budgeted cost of food per dish.

The quote may not be entirely applicable as management may still take action out of other motivations such as the results

from training or personal motivation to demonstrate their own skills. However, the quote is intended to bring into focus the

fact that many people will tend to focus effort on the explicit measures of their performance.

In conclusion, as Metis grows it will need to refine its performance reporting so that management become more efficient in focusing

their work on areas which will achieve the business’ objectives.