(ii) Manipulation of financial statements often does not involve breaking rules, but the purpose of financial statements is to

present a fair representation of the company’s or group’s position, and if the financial statements are misrepresented on

purpose then this could be deemed unethical. The financial statements in this case are being manipulated to hide the

fact that the group has liquidity problems. The Robby Group has severe problems with a current ratio of 0·44

($36m/$81·2m) and a gearing ratio of 0·83 ($53 + 20 + 21 + factored receivables 3·6 + land option 16 =

113·6/equity interest including NCI $136·09m). The sale and repurchase of the land would make little difference to the

overall position of the company, but would maybe stave off proceedings by the bank if the overdraft were eliminated.

Robby has considerable PPE, which may be undervalued if the sale of the land is indicative of the value of all of the

PPE.

Accountants have the responsibility to issue financial statements that do not mislead users as they assume that such

professionals are acting in an ethical capacity, thus giving the financial statements credibility. Accountants should seek

to promote or preserve the public interest. If the idea of a profession is to have any significance, then it must have the

trust of users. Accountants should present financial statements that meet the qualitative characteristics set out in the

Framework. Faithful representation and verifiability are two such concepts and it is critical that these concepts are

applied in the preparation and disclosure of financial information.

2 (a) A lease is classified as a finance lease if it transfers substantially the entire risks and rewards incident to ownership. All other

leases are classified as operating leases. Classification is made at the inception of the lease. Whether a lease is a finance

lease or an operating lease depends on the substance of the transaction rather than the form. Situations that would normally

lead to a lease being classified as a finance lease include the following:

– the lease transfers ownership of the asset to the lessee by the end of the lease term;

– the lessee has the option to purchase the asset at a price which is expected to be sufficiently lower than fair value at

the date the option becomes exercisable that, at the inception of the lease, it is reasonably certain that the option will

be exercised;

– the lease term is for the major part of the economic life of the asset, even if title is not transferred;

– at the inception of the lease, the present value of the minimum lease payments amounts to at least substantially all of

the fair value of the leased asset;

– the lease assets are of a specialised nature such that only the lessee can use them without major modifications being

made.

In this case the lease back of the building is for the major part of the building’s economic life and the present value of the

minimum lease payments amounts to all of the fair value of the leased asset. Therefore the lease should be recorded as a

finance lease.

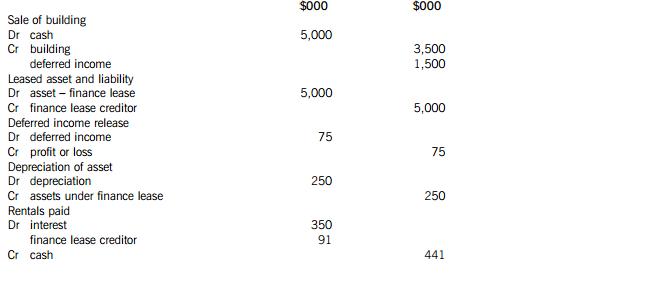

The building is derecognised at its carrying amount and then reinstated at its fair value with any disposal gain, in this instance

$1·5 million ($5m – $3·5m) being deferred over the new lease term. The building is depreciated over the shorter of the lease

term and useful economic life, so 20 years. Finance lease accounting results in a liability being created, finance charge

accruing at the implicit rate within the lease, in this case 7%, and the payment reducing the lease liability in arriving at the

year-end balance. The associated double entry for the lease is as follows: