3 [P.T.O.(b) (i) In the above scenario (information point (v)), Robby holds a portfolio of trade receivables and enters into a

factoring agreement with a bank, whereby it transfers the receivables in exchange for cash. Robby

additionally agreed to other terms with the bank as regards any collection shortfall and repayment of any

monies to Robby. Robby derecognised the receivables. This is an example of the type of complex transaction

that can arise out of normal terms of trade. The rules regarding derecognition are quite complex and are

often not understood by entities.

Describe the rules of HKFRS 9 Financial Instruments relating to the derecognition of a financial asset

and how these rules affect the treatment of the portfolio of trade receivables in Robby’s financial

statements. (9 marks)

(ii) Discuss the legitimacy of Robby selling land just prior to the year end in order to show a better liquidity

position for the group and whether this transaction is consistent with an accountant’s responsibilities to

users of financial statements.

Note: Your answer should include reference to the above scenario. (6 marks)

(50 marks)

4Section B – TWO questions ONLY to be attempted

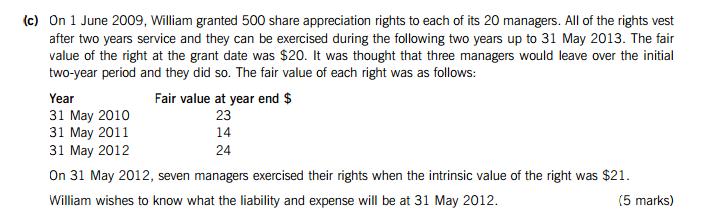

2 William is a public limited company and would like advice in relation to the following transactions.

(a) William owned a building on which it raised finance. William sold the building for $5 million to a finance

company on 1 June 2011 when the carrying amount was $3·5 million. The same building was leased back from

the finance company for a period of 20 years, which was felt to be equivalent to the majority of the asset’s

economic life. The lease rentals for the period are $441,000 payable annually in arrears. The interest rate implicit

in the lease is 7%. The present value of the minimum lease payments is the same as the sale proceeds.

William wishes to know how to account for the above transaction for the year ended 31 May 2012.

(7 marks)

(b) William operates a defined benefit scheme for its employees. At June 2011, the net pension liability recognised

in the statement of financial position was $18 million, excluding an unrecognised actuarial gain of $15 million

which William wishes to spread over the remaining working lives of the employees. The scheme was revised on

1 June 2011. This resulted in the benefits being enhanced for some members of the plan and because benefits

do not vest for these members for five years, William wishes to spread the increased cost over that period.

However, part of the scheme was to be closed, without any redundancy of employees.

William requires advice on how to account for the above scheme under HKAS 19 Employee Benefits including

the presentation and measurement of the pension expense. (7 marks)

(d) William acquired another entity, Chrissy, on 1 May 2012. At the time of the acquisition, Chrissy was being sued

as there is an alleged mis-selling case potentially implicating the entity. The claimants are suing for damages of

$10 million. William estimates that the fair value of any contingent liability is $4 million and feels that it is more

likely than not that no outflow of funds will occur.

William wishes to know how to account for this potential liability in Chrissy’s entity financial statements and

whether the treatment would be the same in the consolidated financial statements. (4 marks)

Required:

Discuss, with suitable computations, the advice that should be given to William in accounting for the above

events.

Note: The mark allocation is shown against each of the four events above.

Professional marks will be awarded in question 2 for the quality of the discussion. (2 marks)

(25 marks)