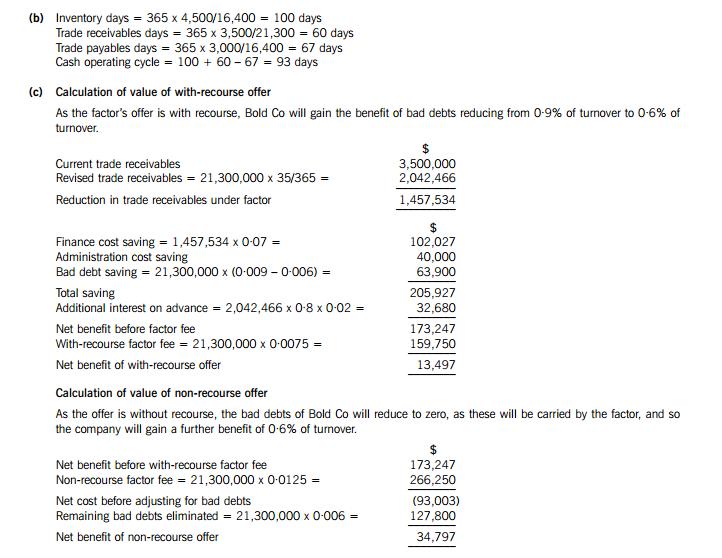

(d) The factor’s offer is financially acceptable on a with-recourse basis, giving a net benefit of $13,497. On a non-recourse basis,

the factor’s offer is not financially acceptable, giving a net loss of $93,003, if the elimination of bad debts is ignored. The

difference between the two factor fees ($106,500 or 0·5% of sales), which represents insurance against the risk of bad debts,

is less than the remaining bad debts ($127,800 or 0·6% of sales), which will be eliminated under non-recourse factoring.

When this elimination of bad debts is considered, the non-recourse offer from the factor is financially more attractive than the

with-recourse offer.

13There are a number of benefits of factoring that could be discussed, as follows.

The expertise of the factor

It is possible the factor can improve the efficiency of the receivables management of Bold Co due to its expertise in the areas

of credit analysis, credit control and receivables collection. This would lead to a lower level of bad debts, as indicated by the

factor’s offer.

Insurance against bad debts

Non-recourse factoring offers protection from bad debts, although the factor’s fee will include the cost of this insurance

element, as indicated by the difference between the factor’s fees.

Factor finance

A factor will advance up to 80% of the value of invoices raised, allowing a company quicker access to cash from sales than

would be possible if it had to wait for accounts receivable to be settled. Bold Co could pay trade payables promptly, perhaps

benefiting from early settlement discounts.

Lower administration costs

Since administration of trade receivables would be taken over by the factor, administration costs of the company would

decrease over time, although some incremental short-term costs, such as redundancy costs, might be incurred.

3 (a) Net asset valuation

In the absence of any information about realisable values and replacement costs, net asset value is on a book value basis. It

is the sum of non-current assets and net current assets, less long-term debt, i.e. 595 + 125 – 70 – 160 = $490 million.