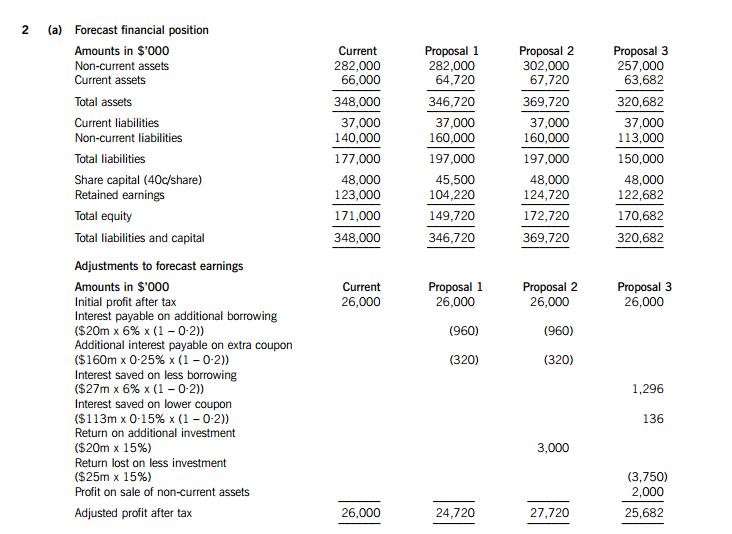

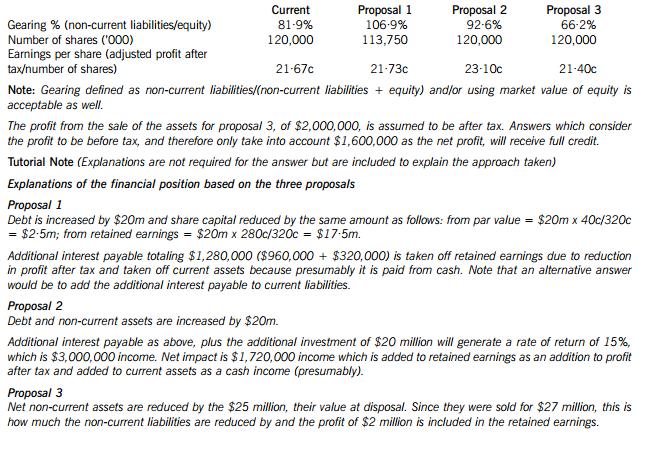

Interest saved totals $1,432,000 ($1,296,000 + $136,000). The reduction in investment of $25 million will lose

$3,750,000, at a rate of return of 15%. Net impact is $2,318,000 loss which is subtracted from earnings as a reduction

from profit after tax and deducted from current assets as a cash expense (presumably). Overall therefore the profit is

reduced by $318,000 [$2,000,000 – $2,318,000].

If the profit from the sale of the asset is assumed to be $1,600,000 ($2,000,000 less tax), then the statement of financial

position, EPS and gearing figures will all change to reflect this.

Discussion

Proposals 1 and 3 appear to produce opposite results to each other. Proposal 1 would lead to a small increase in the earnings

per share (EPS) due to a reduction in the number of shares although profits would decrease by approximately 5%, due to the

increase in the amount of interest payable as a result of increased borrowings. However, the level of gearing would increase

substantially (by about 30%).

With proposal 3, although the overall profits would fall, because of the lost earnings due to downsizing being larger than the

gain in interest saved and profit made on the sale of assets, this is less than proposal 1 (1·2%). Gearing would reduce

substantially (19·2%).

Proposal 2 would give a significant boost in the EPS from 21·67c/share to 23·10c/share, which the other two proposals do

not. This is mainly due to increase in earnings through extra investment. However, the amount of gearing would increase by

more than 13%.

Overall proposal 1 appears to be the least attractive option. The choice between proposals 2 and 3 would be between whether

the company would prefer larger EPS or less gearing. This would depend on factors such as the capital structure of the

competitors, the reaction of the equity market to the proposals, the implications of the change in the risk profile of the

company and the resultant impact on the cost of capital. Ennea Co should also bear in mind that the above are estimates

and the actual results will probably differ from the forecasts.

(Note: credit will be given for alternative relevant comments and suggestions)

(b) Asset securitisation in this case would involve taking the future incomes from the leases that Ennea Co makes and converting

them into assets. These assets are sold as bonds now and the future income from lease interest will be used to pay coupons

on the bonds. Effectively Ennea Co foregoes the future lease income and receives money from sale of the assets today.

The income from the various leases would be aggregated and pooled, and new securities (bonds) issued based on these. The

tangible benefit from securitisation occurs when the pooled assets are divided into tranches and tranches are credit rated. The

higher rated tranches would carry less risk and have less return, compared to lower rated tranches. If default occurs, the

income of the lower tranches is reduced first, before the impact of increasing defaults move to the higher rated tranches. This

allows an asset of low liquidity to be converted into securities which carry higher liquidity.

Ennea Co would face a number of barriers in undertaking such a process. Securitisation is an expensive process due to

management costs, legal fees and ongoing administrative costs. The value of assets that Ennea Co wants to sell is small and

therefore these costs would take up a significant proportion of the income. High cost implications mean that securitisation is

not feasible for small asset pools.

Normally asset pools would not offer the full value of the asset as securities. For example, only 90% of the asset value would

be converted into securities, leaving the remaining 10% as a buffer against possible default. This method of credit

enhancement would help to credit-rate the tranches at higher levels and help their marketability. However, Ennea Co would

not be able to take advantage of the full asset value if it proceeds with the asset securitisation.

(Note: credit will be given for alternative relevant comments and suggestions)