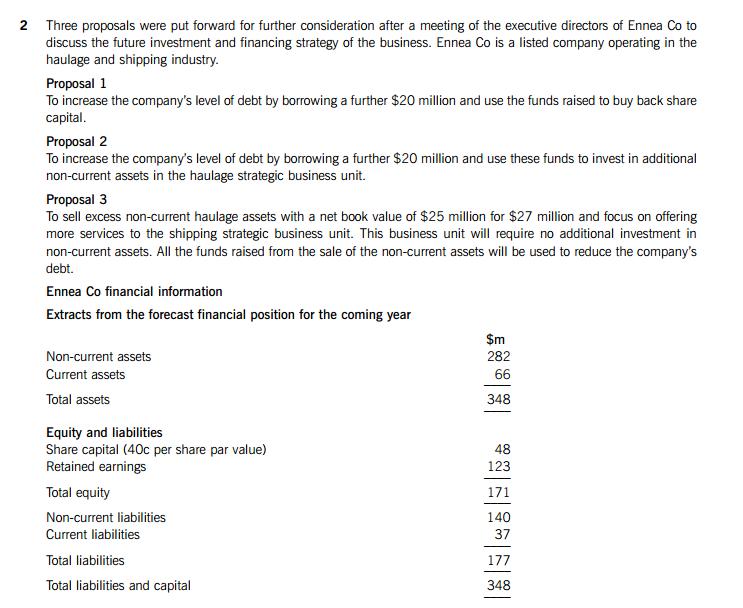

Ennea Co’s forecast after tax profit for the coming year is expected to be $26 million and its current share price is

$3·20 per share. The non-current liabilities consist solely of a 6% medium term loan redeemable within seven years.

The terms of the loan contract stipulates that an increase in borrowing will result in an increase in the coupon payable

of 25 basis points on the total amount borrowed, while a reduction in borrowing will lower the coupon payable by

15 basis points on the total amount borrowed.

Ennea Co’s effective tax rate is 20%. The company’s estimated after tax rate of return on investment is expected to

be 15% on any new investment. It is expected that any reduction in investment would suffer the same rate of return.

Required:

(a) Estimate and discuss the impact of each of the three proposals on the forecast statement of financial

position, the earnings and earnings per share, and gearing of Ennea Co. (20 marks)

(b) An alternative suggestion to proposal three was made where the non-current assets could be leased to other

companies instead of being sold. The lease receipts would then be converted into an asset through securitisation.

The proceeds from the sale of the securitised lease receipts asset would be used to reduce the outstanding loan

borrowings.

Required:

Explain what the securitisation process would involve and what would be the key barriers to Ennea Co

undertaking the process. (5 marks)

(25 marks)

4Section B – TWO questions ONLY to be attempted