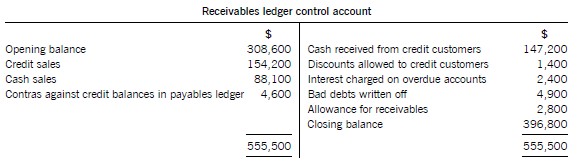

11 The following control account has been prepared by a trainee accountant:

What should the closing balance be when all the errors made in preparing the receivables ledger control account have been corrected?

A $395,200

B $304,300

C $309,500

D $307,100

(2 marks)

12 At 31 December 2004 Q, a limited liability company, owned a building that cost $800,000 on 1 January 1995. It was being depreciated at two per cent per year.

On 1 January 2005 a revaluation to $1,000,000 was recognised. At this date the building had a remaining useful life of 40 years.

What is the depreciation charge for the year ended 31 December 2005 and the revaluation reserve balance as at 1 January 2005?

Depreciation charge Revaluation reserve

for year ended 31 December 2005 as at 1 January 2005

$ $

A 25,000 200,000

B 25,000 360,000

C 20,000 200,000

D 20,000 360,000

(2 marks)

13 P and Q are in partnership, sharing profits equally.

On 30 June 2005, R joined the partnership and it was agreed that from that date all three partners should share equally in the profit.

In the year ended 31 December 2005 the profit amounted to $300,000, accruing evenly over the year, after charging a bad debt of $30,000 which it was agreed should be borne equally by P and Q only.

What should P’s total profit share be for the year ended 31 December 2005?

A $ 95,000

B $122,500

C $125,000

D $110,000

(2 marks)

14 A company has made a material change to an accounting policy in preparing its current financial statements.

Which of the following disclosures are required by IAS 8 Accounting policies, changes in accounting estimates and errors in the financial statements?

1 The reasons for the change.

2 The amount of the adjustment in the current period and in comparative information for prior periods.

3 An estimate of the effect of the change on the next five accounting periods.

A 1 and 2 only

B 1 and 3 only

C 2 and 3 only

D 1, 2 and 3

(2 marks)

15 According to IAS 2 Inventories, which of the following costs should be included in valuing the inventories of a manufacturing company?

(1) Carriage inwards

(2) Carriage outwards

(3) Depreciation of factory plant

(4) General administrative overheads

A All four items

B 1, 2 and 4 only

C 2 and 3 only

D 1 and 3 only

(2 marks)

16 Part of a company’s cash flow statement is shown below:

$’000

Operating profit 8,640

Depreciation charges (2,160)

Increase in inventory (330)

Increase in accounts payable 440

The following criticisms of the extract have been made:

(1) Depreciation charges should have been added, not deducted.

(2) Increase in inventory should have been added, not deducted.

(3) Increase in accounts payable should have been deducted, not added.

Which of the criticisms are valid?

A 2 and 3 only

B 1 only

C 1 and 3 only

D 2 only

(2 marks)

17 Which of the following explains the imprest system of operating petty cash?

A Weekly expenditure cannot exceed a set amount.

B The exact amount of expenditure is reimbursed at intervals to maintain a fixed float.

C All expenditure out of the petty cash must be properly authorised.

D Regular equal amounts of cash are transferred into petty cash at intervals.

(2 marks)

18 Which of the following are differences between sole traders and limited liability companies?

(1) A sole traders’ financial statements are private; a company’s financial statements are sent to shareholders and may be publicly filed

(2) Only companies have capital invested into the business

(3) A sole trader is fully and personally liable for any losses that the business might make; a company’s shareholders are not personally liable for any losses that the company might make.

A 1 and 2 only

B 2 and 3 only

C 1 and 3 only

D 1, 2 and 3

(2 marks)

19 Which of the following documents should accompany a payment made to a supplier?

A Supplier statement

B Remittance advice

C Purchase invoice

(1 mark)

20 Goodwill should never be shown on the balance sheet of a partnership.

Is this statement true or false?

A False

B True

(1 mark)

21 Which of the following journal entries are correct, according to their narratives?

Dr CR

$ $

1 Suspense account 18,000

Rent received account 18,000

Correction of error in posting $24,000 cash received for rent to the rent received account as $42,000

2 Share premium account 400,000

Share capital account 400,000

1 for 3 bonus issue on share capital of 1,200,000 50c shares

3 Trade investment in X 750,000

Share capital account 250,000

Share premium account 500,000

500,000 50c shares issued at $1.50 per share in exchange for shares in X

A 1 and 2

B 2 and 3

C 1 only

D 3 only

(2 marks)

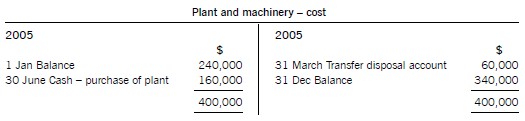

22 The plant and machinery account (at cost) of a business for the year ended 31 December 2005 was as follows:

The company’s policy is to charge depreciation at 20% per year on the straight line basis, with proportionate depreciation in the years of purchase and disposal.

What should be the depreciation charge for the year ended 31 December 2005?

A $68,000

B $64,000

C $61,000

D $55,000

(2 marks)

23 Which of the following should appear in a company’s statement of changes in equity?

1 Profit for the financial year

2 Amortisation of capitalised development costs

3 Surplus on revaluation of non-current assets

A All three items

B 2 and 3 only

C 1 and 3 only

D 1 and 2 only

(2 marks)

24 Which of the following statements are correct?

(1) Capitalised development expenditure must be amortised over a period not exceeding five years.

(2) Capitalised development costs are shown in the balance sheet under the heading of Non-current Assets

(3) If certain criteria are met, research expenditure must be recognised as an intangible asset.

A 2 only

B 2 and 3

C 1 only

D 1 and 3

(2 marks)

25 A fire on 30 September destroyed some of a company’s inventory and its inventory records.

The following information is available:

$

Inventory 1 September 318,000

Sales for September 612,000

Purchases for September 412,000

Inventory in good condition at 30 September 214,000

Standard gross profit percentage on sales is 25%

Based on this information, what is the value of the inventory lost?

A $96,000

B $271,000

C $26,400

D $57,000

(2 marks)