Online sales

There is a risk that revenue is not recognised at the correct time, as it can be difficult to establish with online sales when

the revenue recognition criteria of HKAS 18 Revenue have been met. This could mean that revenue and profits are at

risk of over or understatement. This is a significant issue as 30% of Canary Co’s sales are made online, which

approximates to sales of $4·8 million or 3·6% of this year’s consolidated revenue, and will be a higher percentage of

total sales next year when a full year of Canary Co’s revenue is consolidated.

Prior to the acquisition of Canary Co, the CS Group had no experience of online sales, which means that there will not

yet be a group accounting policy for online revenue recognition.

There may also be risks arising from the system not operating effectively or that controls are deficient leading to

inaccurate recording of sales.

Canary Co management

As this is the first time that Canary Co’s management will be involved with group financial reporting, they will be

unfamiliar with the processes used and information required by the CS Group in preparing the consolidated financial

statements. There is a risk that information provided may be inaccurate or incomplete, for example in relation to

inter-company transactions.

Financial performance

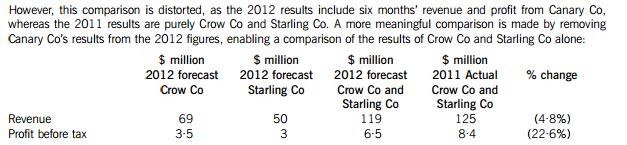

Looking at the consolidated revenue and profit figures, it appears that the group’s results are encouraging, with an

increase in revenue of 8% and in profit before tax of 1·2%.