| 商家名称 | 信用等级 | 购买信息 | 订购本书 |

|

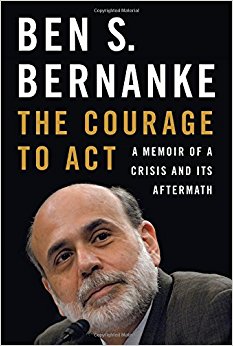

The Courage to Act: A Memoir of a Crisis and Its Aftermath |  |

|

|

The Courage to Act: A Memoir of a Crisis and Its Aftermath |  |

A New York Times Bestseller

An unrivaled look at the fight to save the American economy.

In 2006, Ben S. Bernanke was appointed chair of the Federal Reserve, the unexpected apex of a personal journey from small-town South Carolina to prestigious academic appointments and finally public service in Washington’s halls of power.

There would be no time to celebrate.

The bursting of a housing bubble in 2007 exposed the hidden vulnerabilities of the global financial system, bringing it to the brink of meltdown. From the implosion of the investment bank Bear Stearns to the unprecedented bailout of insurance giant AIG, efforts to arrest the financial contagion consumed Bernanke and his team at the Fed. Around the clock, they fought the crisis with every tool at their disposal to keep the United States and world economies afloat.

Working with two U.S. presidents, and under fire from a fractious Congress and a public incensed by behavior on Wall Street, the Fed―alongside colleagues in the Treasury Department―successfully stabilized a teetering financial system. With creativity and decisiveness, they prevented an economic collapse of unimaginable scale and went on to craft the unorthodox programs that would help revive the U.S. economy and become the model for other countries.

Rich with detail of the decision-making process in Washington and indelible portraits of the major players, The Courage to Act recounts and explains the worst financial crisis and economic slump in America since the Great Depression, providing an insider’s account of the policy response.

16 pages of photographs 媒体推荐“Revelatory…the book sheds light on many of the smaller dramas that hang over this crucial period of world economic history.” (New York Times)

“Undoubtedly the best account we will ever have of how government and financial institutions dealt with what has come to be known as the Great Recession.” (New York Times Book Review)

“A careful, detailed, and exceptionally clear justification for the Fed’s aggressive actions to avert another Great Depression and resuscitate the American economy.” (Washington Post)

“Bernanke’s insights are instructive about what went wrong and how to keep it from happening again.” (Los Angeles Times)

“A fantastic and reasonably accessible introduction to the economic thought of a former Federal Reserve Chair.” (Vox)

“A fascinating account of the effort to save the world from another catastrophe [like the Great Depression]…. Under Bernanke’s chairmanship, the Fed, whatever its pre-crisis mistakes, helped save the U.S. and the world from a disaster. Humanity should be grateful.” (Martin Wolf - The Financial Times)

Ben S. Bernanke served as chairman of the Federal Reserve from 2006 to 2014. He was named Time magazine's "Person of the Year" in 2009. Prior to his career in public service, he was a professor of economics at Princeton University.

网友对The Courage to Act: A Memoir of a Crisis and Its Aftermath的评论

一本真正的专业通俗读物。非常适合想了解美国金融市场运作实际的人。

It was fascinating to read about the how & why we got into the Great Recession & why the country still hasn't fully recovered & how it likely won't ever return to where it was prior to 2007. Some of what I learned was (and reinforced my beliefs) that there is no absolute truth or to put it another way, we each have our own truths & that can get us into serious trouble if we are unwilling to compromise as is currently happening all over our society - left & right!

The down side of this tome was the frequent & recurrent use of acronyms & mnemonics. Even though he explains concepts & department functions unless you have some financial background, as I fortunately do, you can get VERY lost in the weeds.

I strongly recommend this book for everyone interested in what we all just went through. I look forward to reading other analyses five or more years down the road.

I was dithering whether or not to buy this book until I started reading the negative reviews. People who haven't even bothered to read the book trouncing it because of their political views. I bought it as a protest against ignorance. And, as a result, I was treated to an insider's view of what went on during the financial crisis.

Most of what he covers has been written about by other people, so there weren't any great surprises. But I'm impressed by Bernake's obvious intelligence, the thoughtfulness of how he and his peers went about combating the economic crisis, and the insider's view that very few of us are allowed to see. Bernake had a first hand view of what was done right, what went wrong and how things could have been so much worse. His academic approach, as opposed to the ideological demagoguery that fills so much of our discourse, was refreshing.

I tend to read a lot of financial press (I read both the Economist and the Wall Street Journal) so I find most of this fascinating, and it did clear up my understanding of the regulatory failures that contributed to the crisis, as well as how our country's response likely saved us from a depression.

I highly recommend for people who want to understand what actually went on.

Just finished this well written and educational book. Americans and for that matter, the world, should be grateful that during a time of grave financial crisis, capable men like Ben Bernancke, Tim Geithner, Hank Paulson etc. and staff worked 24-7 to prevent it spiralling out of control. And in the aftermath despite doubts and criticism Ben had the courage to pursue unconventional monetary policy in order that the US did not sink into the long and protracted 1930s style Depression.

While this book is partly about economics, there is a substantial infusion of political science, sociology and psychology. Unlike the silo, one needs a broad, range of understanding to deal with the problems. Leadership is important, in the social sciences one can't reduce things to an equation. One needs a panel of people to arrive at effective decisions. Bernanke used his committees well, and was a major reason why we weren't in worse trouble than we were. In a way, it also sheds light on what is wanting in graduate education, where there is little attempt to foster broad ranges of understanding so that the problems can be dealt with.

喜欢The Courage to Act: A Memoir of a Crisis and Its Aftermath请与您的朋友分享,由于版权原因,读书人网不提供图书下载服务